- Causes of Future Sea Level Rise

- Elevation Maps

- Will we really lose all that land?

- Sea Level Rise Planning Maps

5.2.1 Tas Advantages when Donated

The tax benefits from conservation easements are well established, and land trusts take considerable care both to inform potential donors about tax rules and to ensure that their own operations conform to the tax code so that tax deductions for their donors are not jeopardized. A tax-deductible donation of a possibility of reverter, by contrast, would often not be practical;[443] so this section focuses on shoreline migration conservation easements. (The tax implications of an affirmative rolling easement for beach access would be similar.[444]) We start with some background about the tax implications of conservation easements in general, and then look at how those concepts apply to rolling easements. This chapter does not provide tax advice, and its analysis of tax laws cannot be used to avoid tax penalties.

5.2.1.1 Conservation

Easements

For standard conservation easements, both the land trust and the landowner generally assume that without the conservation easement, the land may eventually become developed and lose key environmental functions.[445] With that assumption, the conservation easement benefits the public and the environment by maintaining the environmental functions of the property in its natural state. The property owner loses the opportunity to develop the land, which reduces its market value. But the tax code provides several tax advantages, which are generally worth a significant fraction (e.g. 50 percent) of the decline in market value. An investor-landowner who is planning to eventually sell or develop the land will be unwilling to provide a conservation easement unless the land trust will make up the difference (e.g. pay for the diminution in value minus the tax savings). But a landowner with no intention of selling or developing could view the tax savings as, in effect, a reward for a conservation ethic that he is already following; so he may gladly donate an easement. Owners concerned about both conservation and the value of the estate they pass on to their heirs may require some payment, but less than what an investor would require.[446]

There are two primary sources of tax savings for most property owners. First, the donation of an easement is a charitable contribution[447] equal to its fair market value,[448] which is generally the diminution in land value resulting from the restrictions.[449] Although the deduction is limited to 30 percent of one's adjusted gross income, the deduction can be spread out over many years.[450] Second, the diminution in value lowers the assessment for property taxes.[451] These two provisions can, in effect, refund about half the value of a donated easement to the property owner. In addition, property subject to a conservation easement may be partly excluded from the inheritance tax, for those with estates large enough to be subject to that tax;[452] and in some states conservation easements entitle the landowner to a lower property tax rate.

This chapter does not provide tax advice, and its analysis of tax laws cannot be used to avoid tax penalties.

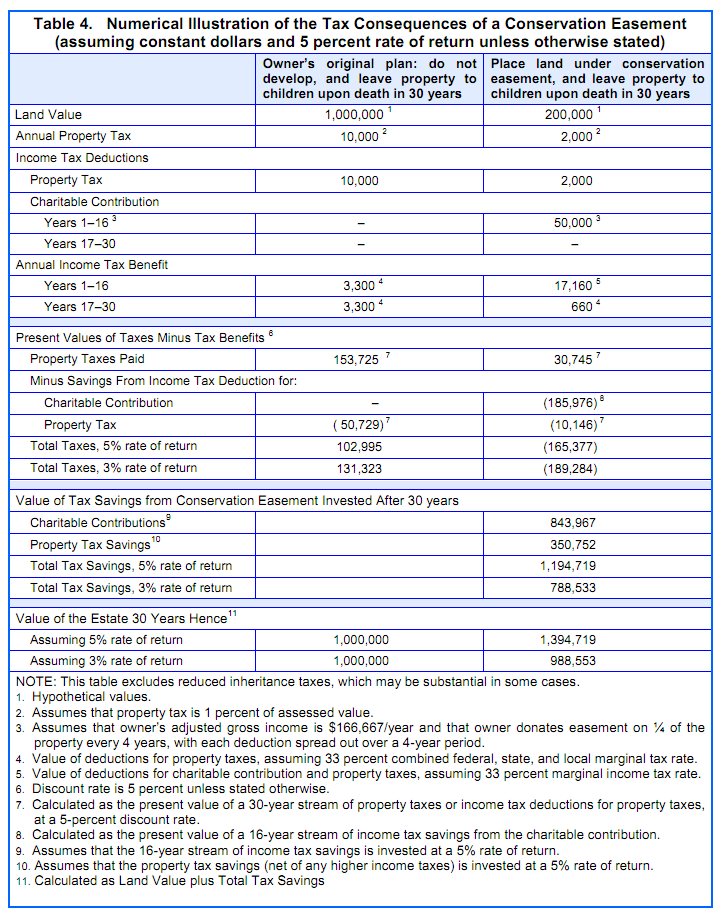

The size of these tax incentives, in effect, can overcompensate some landowners given their objectives. If the land would not have been developed for decades anyway, the conservation easement has no impact during the next several decades. And yet the owner is compensated by the tax system based on market value, which assumes the owner could develop now. As a numerical illustration, consider the owner of a farm assessed at $1,000,000 whose profits from farming only justify a property value of $200,000.[453] The diminution in value from a conservation easement (and hence the income tax deduction) would be $800,000. If the landowner plans to not develop the property in his lifetime, which he assumes to be 30 more years, from his standpoint the conservation easement means that upon his death his heirs would inherit a farm worth $200,000 instead of $1 million. At a 5 percent rate of return, $185,000 today would grow to $800,000 by that time, so paying the owner $185,000 today would compensate him for the expected decline in the value of his estate. In some cases, the income tax savings from the $800,000 tax deduction alone would be worth more than $185,000.[454] In other cases, the decline in property taxes combined with the income tax deduction would be worth more than $185,000. Table 4 provides the details for a hypothetical owner in the 33 percent income tax bracket (federal and state) and a property tax rate of 1 percent of market value. In this case, the tax savings (if invested) would grow to between $800,000 and $1,200,000 over the 30-year period (constant dollars), depending on the discount rate, which would be roughly comparable to (or slightly more) than the decline in market value from the conservation easement. If the tax savings alone are greater than the value of what the landowner gives up, economists might say that the tax system “overcompensates” the landowner.

The overcompensation occurs because there is a class of property owners who are, in effect, already giving something to society by not developing their land now. But they are not getting a tax deduction for that sacrifice. By agreeing to never develop their land, they are given a tax deduction for both the additional sacrifice and for the current sacrifice. As a result, the total tax savings can be greater than the value of the additional sacrifice, providing some compensation for the sacrifice the owner is already making. In the extreme case where the owner and his heirs would never develop or sell the land anyway, the tax savings are very attractive.

|

5.2.1.2 Rolling

Easements

Unlike the typical conservation easement, a rolling easement is likely to have a small impact on the land's market value and the resulting tax savings, except for very low-elevation or erosion-prone properties whose demise is relatively imminent. The present value of protecting an eroding farm that would otherwise be gradually consumed over a 300-year period would be about 7 percent of the farm's value (assuming, for example, a 5 percent discount rate);[455] the diminution in value from a rolling easement should be the present value of the lost property minus the cost of the shore protection. In areas where development is unlikely or precluded by existing policies, the cost of shore protection may greater than the land value,[456] which is why shore protection is rare in many rural areas.[457] The rolling easement would not lower the market value of such land; so donating it should neither create a tax deduction nor lower the assessed valuation for purposes of the property tax.

For home lots, by contrast, the diminution in value from a rolling easement is likely to be unambiguous—albeit small. For example, at a 5 percent discount rate, the certain loss of a home fifty years hence reduces the property value by 9 percent if shore protection would otherwise be free.[458] If the shore protection cost would be 1/6 of the property value[459] fifty years hence, the rolling easement would reduce the property's value by about 7.5 percent.[460] On a $500,000 home, this would be a deduction of $37,500, worth about $12,500 for someone in the 33 percent income tax bracket. One may also obtain property tax savings of a few hundred dollars per year (e.g., a 7.5 percent reduction on a property tax bill of a few thousand dollars). More typically, however, if the loss of the home will be one hundred years hence (with similar shore protection costs), then the rolling easement will reduce the property value by about $3,000, below the $5,000 threshold requiring an appraisal to document the value of the deduction.[461] These estimates of the market value of a rolling easement each assume that landowners would protect their property without the rolling easement. There is some chance, however, that shore protection is not a property right, and that a government agency would not allow shore protection.[462] These calculations also assume that buyers and sellers all have the same expectations about the risk of sea level rise to the property.

The actual impact of a rolling easement on market value could be greater if (for example) potential homebuyers fear a higher rate of sea level rise than commonly assumed, or if they simply resist purchasing lands subject to the easement. [463] The impact could be less if the market tends to underestimate the expected loss from improbable events, which some studies imply.[464] Those cases where the impact on market value is empirically greater than suggested by standard formulas would be particularly good candidates for donated rolling easements, because the donor's tax deduction would be greater than the true impact of the rolling easement on the property.[465] Cases where the market value is less than the intrinsic value would be better candidates for purchased rolling easements, because the price would be lower—or exacted rolling easements, because a trivial impact on property values would meet less resistance from developers, and be less likely to require substantial just compensation even if it were found to be a taking.

To the extent that tax incentives motivate donations of conservation easements, land trusts are likely to find donations of rolling easements more difficult to obtain than donations of standard conservation easements. For some owners, the fair market value of a conservation easement is many times what it would take to induce them not to develop their land because they do not want to develop anyway. So if the tax system provides an inducement equal to 30–50 percent of the decline in their property value, it is a good deal for them. For donations of rolling easements to be attractive based on tax savings alone, there would have to be a class of landowners who are already inclined to avoid shore protection, and would therefore view the tax benefits of a rolling easement as more than enough compensation to formally agree to avoid shore protection. But there is probably not a large class of homeowners or developers with a strong commitment to seeing their property submerged below a rising sea.[466]

Nevertheless, rolling easements could provide tax savings sufficient to induce owners to donate them if the guarantee of future shoreline migration persuades land trusts to accept conservation easements for land where they would otherwise not be willing to accept them. Consider, for example, the owner of a $1 million lot with one home on one acre, which can be subdivided into five lots. If the owner subdivides and puts four of the lots under a conservation easement, the tax consequences will be similar to the case of the $1 million farm we just discussed. (See Table 4.) Today, the owner would probably be unable to find a land trust willing to accept a conservation easement on this property, because the conservation value of keeping one acre of moderate-density housing from becoming higher-density is minimal. A land trust (or government agency) attempting to ensure wetland migration, however, may be willing to accept a rolling easement on the parcel with a condition of no additional development—especially if the one-acre lot is adjacent to an area the trust is already preserving, and several owners are all interested in the same arrangement. In such a case, the tax benefits from an $800,000 decline in market value would become available. In this example, the donation of rolling easements would partly compensate landowners on moderate-density residential property for resisting market forces that would otherwise lead to dense development where shore protection would be inevitable. This result could also be achieved with transferable development rights (as discussed in Section 3.4.2).

Moreover, if markets were to substantially overvalue rolling easements due to buyer resistance, the tax benefits could even justify donating a rolling easement that did not restrict development. For example, at a 5 percent rate of return, the present value of losing a $200,000 parcel 150 years hence would be $132. Yet real estate experts may advise people against buying homes with rolling easements, which might (for example) depress the market value by 5–10 percent. If such a market impact could be substantiated by a qualified appraisal,[467] then the resulting tax deduction of $10,000–$20,000 could be viewed as overcompensation by someone who expected his family to keep the property until the end, especially if he was more doubtful than the conventional wisdom about either future sea level rise or the feasibility of shore protection. But until valuation studies are available, appraisers will have to account for uncertainty by using standard economic formulae (such as the Black-Scholes method for valuing options[468]) which do not assume irrational buyer resistance, using an estimate of the probability distribution of future sea level rise.

5.2.2 When Sold at Fair Market Value

By definition, a rolling easement sold for fair market value is not a charitable contribution. The tax consequences of a rolling easement are similar to the consequences whenever one sells part of his land: If the land has appreciated, then there may be a taxable capital gain; and the market value of the remaining property declines by the sale price, which in turn should reduce the assessed valuation and property taxes proportionately. Because rolling easements are new, however, some tax assessors may be reluctant to recognize the resulting decline in fair market.[469] Nevertheless, a tax assessor would be more likely to rely on the results of an actual sales transaction than to rely on the estimate of an appraiser; so sales of easements are more likely to reduce property taxes than donations.

5.2.3 Exacted Rolling Easements

Easements exacted as a permit condition are unlikely to provide tax benefits, but the permit itself would be a substantial benefit to a developer who transfers a rolling easement. Exacted rolling easements would not be charitable contributions, because they would be transferred in exchange for something of value (the permit). Real estate taxes are unlikely to decline, because the permit enhances the property value. Nevertheless, an exacted rolling easement could still benefit a developer more than it costs. Just as a buyer of rolling easements can adjust the purchase price to the level necessary to induce a sale, a land use authority committed to ensuring landward migration of wetlands may be able to adjust what is awarded by the permit. A small increase in allowable density, for example, could be sufficient inducement for a developer to voluntarily transfer a rolling easement on the property.[470]

Other advantages to a developer are possible. Most lots in the typical coastal development would not be along the water, and some potential buyers of non-waterfront land may be more attracted to the idea of a community with a sustainable vision of its response to sea level rise than they are put off by the fact that in the very long run, their homes would be submerged—perhaps because other communities with no plan for rolling easements are not necessarily safer. Moreover, the eventual loss of their homes may[471] only occur after a period during which their land would be waterfront; in many cases, the value of owning waterfront land for a few decades would be greater than the cost of completely losing the land thereafter.[472] Those buyers who are not concerned about sea level rise, by contrast, may view the rolling easement as costing nothing because they do not expect the sea to rise much within their planning time horizon.

Risks to a developer are also possible. No one knows whether an extreme buyer resistance to rolling easements will arise, though fear of this being the case might deter some developers. There is little evidence of an irrational buyer resistance in Texas, where most—but not all—property along the Gulf of Mexico has been subject to a rolling easement which has been regularly enforced. Nevertheless, if buyer resistance unreasonably depressed the value of land subject to a rolling easement, it could be reasonable to add a safety valve. For example, in a neighborhood where land is unlikely to be submerged for 75 years, restrictions could provide that the home will not have to be abandoned during the next 75 years. Such a provision would have a minimal impact on the environmental result of the rolling easement, while assuring the buyer that the rolling easement will not disrupt his enjoyment of the land for at least the next 75 years. This safety valve might threaten the deductibility of a donated conservation easement,[473] but exacted rolling easements would not be tax-deductible anyway.

[443] I.R.C.

§ 170(f)(3) disallows

deductions for a contribution of “less than the

taxpayer's entire interest,” with a few exceptions that do not apply. A

developer who retains a possibility of reverter can take the deduction because the

possibility of reverter is all that remains after selling the fee simple

determinable to homebuyers; however, such “donations” may be business expenses

anyway, especially if the possibility of reverter is exacted as a permit

condition. Landowners who intend to

retain a fee simple determinable while transferring a possibility of reverter to

a land trust would generally own nothing but the possibility of reverter for a

period of time during which it is donated to the land trust, supra note 260,

and seemingly qualify for the deduction. But the IRS may look at the transaction as a

whole, which is a donation of less than the entire

interest.

[444] See I.R.C. §170(h)(4)(a)(i) (“For purposes of this subsection, the

term 'conservation purpose' means . . . (i) the preservation

of land areas for outdoor recreation by, or the education of, the general

public. . . . ”)

[445]

See, e.g.., Debra

Wolf Goldstein, The Heritage Conservancy, Using Conservation Easements to

Preserve Open Space: A Guide for Pennsylvania's Municipalities 27 (2002)

[hereinafter Heritage

Conservancy].

[446] For example,

if the owner is provided a payment that, if

invested along with the tax savings, will grow enough to equal the

diminution in value by the time of the landowner's expected death, the owner

can leave his heirs an estate with

the same value as if he simply refrains from development and

does

not attach a

conservation easement to the property.

[447] I.R.C.

§§ 170(a),

170(f)(3)(B)(iii), &

170(h).

[448]

26 C.F.R.

§1.170-1(e).

[449]

The value of the easement donated is calculated as the difference between the

market value before and after the conservation easement is created. See, e.g., Hilborn v. Commissioner, 85 T.C. 677,

688 (1985).

[450] I.R.C.§170(b)(1)(B)(i). The deduction can be carried over for

the next five years. I.R.C.§170(b)(1)(B). The total charitable deduction

is

limited to 1.8

times the taxpayer's adjusted gross income. Id. If the total value of a

conservation easement is 3.6 times one's gross income, one may donate a conservation easement

worth 1.8 times the adjusted gross income one year, and donate a conservation

easement on the rest of the property 6 years later,

[451] See, e.g.,, Daniel C. Stockford, Property Tax Assessment of Conservation

Easements, 17 B. C. Envtl. Aff. L.

Rev. 823, 831 n.47 (1990) (listing statutes that

specifically require a reduction in assessed valuation of land subject to a

conservation easement for Connecticut, Florida, Georgia, Maine, Maryland,

Massachusetts, New Hampshire, New Jersey, North Carolina, Pennsylvania, and

Virginia). Nevertheless, land trusts often warn potential donors that their

assessment for property taxes may not decline as much as the market value

declines. Id. at

826.

[452] 26 U.S.C.

§

2031 (a) and

(c).

[453]

In Stotler v. Commissioner, for example, the tax court accepted a

landowner's claim that a conservation easement reduced the value of a coastal

property by 91 percent. 53 T.C. 973

(1987).

[454] A

taxpayer with adjusted gross income of $2.5 million at the 40% marginal (federal

and state) income tax rate could deduct the entire $800,000 during the year of

the donation, for an income tax savings of $320,000. But a taxpayer with an adjusted gross

income of $100,000 could only deduct $30,000 per year, and the marginal tax rate

would be lower. See supra note 450.

[455]

At a discount rate of 5%, a farm with profits of $50,000/year would be worth

$1,000,000. If the farm lost 1/300 of its land each year and hence profits

declined by $166.67 each year, then the present value of the income stream would

be $930,000 (7 percent decline). At

a 3% discount rate, the present value would be $890.000 (11 percent

decline).

[456]

E.g., preventing an entire farm from

being eroded or inundated would often cost more than

$70,000.

[458] I.e., 1/(1.0550)=0.087, which

is approximately 9 percent. Although shore protection is not free,

if it is subsidized with no cost to the landowner, then it does not lower the

fair market price of a rolling easement.

[459] A

typical revetment costs about $200/foot, so a 100-foot revetment would cost

about $20,000. See, e.g., Sorenson et

al., 1986. Trucked-in sand often costs approximately 50 cents to one dollar per

cubic foot. Therefore, elevating a 10,000-square-foot lot by one foot would cost

$5,000–$10,000. Elevating homes can cost tens of thousands of

dollars.

[460]

If the cost of shore protection 50 years hence would be one-sixth the current

property value, then the present value of the future shore protection cost

avoided would be one-sixth of the present value of losing the property,

calculated in note 458

(about 1.5 percent), and the net impact on today's property value would be the

difference.

[461] 26 C.F.R.

§ 1.170A-13(c)(2)(i)(A).

[462] If one could

assess the probability that a court would find that there is no right to shore

protection (A) and that the

government would not allow shore protection (B), then the value of a rolling

easement should be further discounted by that likelihood (A times B), in the case of a donation to a land

trust. If an easement is purchased

by the very agency that could issue the

permit for shore protection, the value need only be discounted by the likelihood

that there is no right to shore protection (A).

[463]

Cf., Ben Lanskink & Ward

Lanskink, Appraisals and Consulting,

Diminution in Value, Injurious Affection: Non-Visible Easements (Toronto

2010) (buyer resistance to easement that did not affect use of existing property

caused 14 percent reduction in property value); and P.J. Rohan, The Model Condominium Code: A Blueprint for

Modernizing Condominium Legislation, 78 Colum. L. Rev. 587, 595 (1978) (warning

of buyer resistance to poorly understood condominium

restrictions).

[464] E.g., H.

Kunreuther & M. Pauly, Neglecting

Disaster: Why Don't People Insure against Large Losses? 28 Journal of Risk

and Uncertainty 5–21

(2004); and K. J. Arrow, Risk

Perception in Psychology and Economics, 20 Economic Inquiry 1–9

(1982).

[465] This assertion

assumes that the owner intends to retain the property until submergence, or will

sell it to someone who correctly values the implication of the rolling easement.

For additional discussion on how tax deductions for contributing conservation

easements can be greater than the actual impact on the donor.

See supra notes 446–451,

Table

4, and accompanying

text.

[466] There may be a

significant number of oceanfront landowners who would be willing to provide an

affirmative rolling easement to allow access along the dry beach seaward of the

dune, as long as such an easement did not have priority over their own use of

the land, such as dune maintenance and keeping a home that encroaches seaward of the dune. Such easements might not significantly

reduce property values and hence may have a negligible tax

benefit. They might even benefit

the property. See supra note 411

(discussing suspension of beach nourishment in West Galveston until waterfront

landowners conveyed rolling

easements).

[467] The IRS

requires appraisals to be based on comparable sales information where it is

available. 26 C.F.R. § 1.170A-14(h)(3)(i). There is generally not a

resale

market for

conservation easements themselves because the primary value of a conservation

easement does not accrue to the easement holder but to society and posterity.

IRS rules require considering comparable sales of properties with and without

the restriction. Id. But reliable

information is often unavailable because the potential for development varies

site by

site. Even if a

neighbor has sold an easement to a land trust, the sale might not be

comparable. The

future loss of a property, by contrast, would be a straightforward function of

elevation and projected sea level rise—and shore protection costs are easily

estimated. Appraisals often include adjustments for differences between the

properties when those differences are readily quantified. See, e.g., Stotler v.

Commissioner, 53 T.C. 973 (1987). Therefore, the market value of a rolling easement can probably be

substantiated by a

comparable sale for other properties with similar elevations, with differences

in the market price of the property providing the basis for adjusting the market

price of a rolling easement. For a discussion of the economics of qualified appraisals, see James Boyd, Kathryn Caballero,

& R. David Simpson, The Law and

economics of Habitat Conservation: Lessons from an Analysis of Easement

Acquisitions (Resources for the Future Working Paper No. 9932,

1999)

[468]

Fischer Black & Myron Scholes, The

Pricing of Options and Corporate Liabilities, 81 The Journal of Political Economy 647–654

(1973). Because the value of a

rolling easement declines exponentially with the year by which the land will be

submerged, the high end of the uncertainty range for sea level rise dominates

the value of a rolling easement.

[469] Cf. supra note 451.

[470] The increase

in density required to offset the impact of the rolling easement

depends on the profits per unit, and

the impact of a rolling easement on property values. This type of inducement is the

temporal

equivalent of transferable development

rights. The period extending from now until whenever the property becomes

threatened is the receiving epoch, while the

more distant future is the sending epoch. Given the relative present values of a

rolling easement and a development permit, a fairly small number of additional

units should generally be sufficient inducement for a developer to place a

rolling easement on all but the most low-lying (but

easily protected) lands.

[471] This scenario

would occur on an eroding shore or along estuaries with at least a small slope

proceeding inland. In areas with

ridges or natural levees along the shore and minimal erosion, the inland parcels

could be submerged while waterfront

parcels remain habitable.

[472] For example,

at a 3 percent discount rate, the value of a 26-year estate is slightly greater

than half the value of owning the land forever (i.e. fee simple absolute). Therefore, if the premium for

being

waterfront doubles

the value of the land, one would be slightly better off with a waterfront lot

that will be lost in 24 years than a nonwaterfront lot that will be retained

forever. At a 5 percent discount rate, the break-even point would be 17

years. But cf. supra notes 463–465

and 467–468

and accompanying text (no research is available on whether markets would

overvalue or undervalue rolling easements, and suggesting that donations are

appropriate if markets overvalue while purchases or exactions are appropriate if

markets undervalue the easements).

[473] The requirement for the restrictions that apply in perpetuity may also imply that they must not be postponed significantly. Cf. 26 C.F.R. § 1.170A-14(g) (disallowing deduction for a remainder interest if the current tenants are allowed to undertake activities that reduce the conservation purpose of the donation in a subsection defining the general requirements of “in perpetuity”). Allowing a home to remain on site for 75 years, however, is not the same as allowing shore protection for 75 years; so allowing the home to remain for 75 years may be consistent with the conservation objective.

This page contains a section from: James G. Titus, Rolling Easements, U.S. Environmental Protection Agency. EPA-430-R-11-001 (2011). The report was originally published by EPA's Climate Ready Estuary Program in June 2011. The full report (PDF, 176 pp., 7 MB) is also available from the EPA web site.

For additional reports focused on the implications of rising sea level, go to Sea Level Rise Reports.

5.1 For the Community

5.1 For the Community